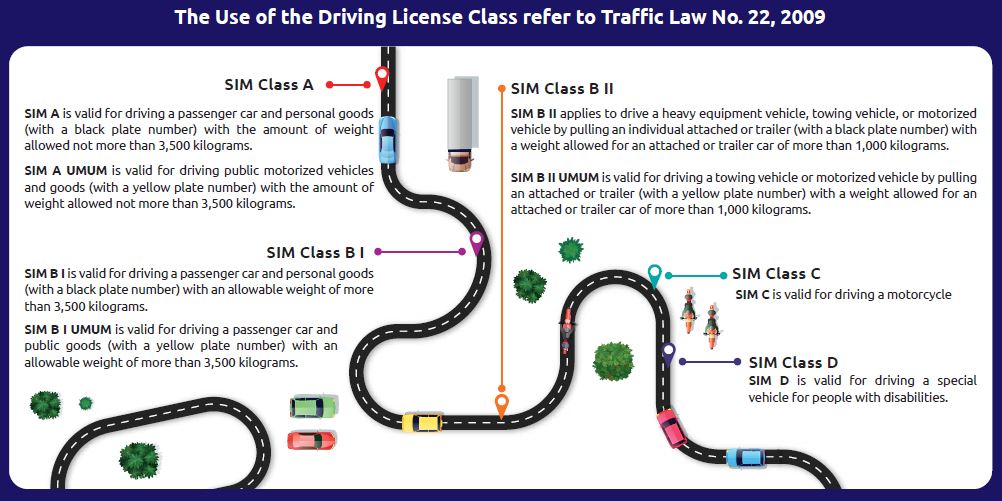

Did You Know? Driving License (SIM)

SIM (Driving License) is one of the mandatory document in filing a motor vehicle claim. SIM is a proof of registration and identification given by the National Police to someone who has met the administrative requirements, is physically and mentally healthy, understands traffic regulations, and is skilled in driving a motorized vehicle.

Legal Basis

Every motorized vehicle driver is required to have a Driving License. This regulation is stated in Article 77 paragraph 1 of Law No. 22, 2009 regarding Road Traffic and Transportation, that every motorized vehicle driver in the area is required to have a Driving License (SIM).

It is also mentioned in Indonesian Motor Vehicle Insurance Standard Policy (PSAKBI) Chapter II Article 3 paragraph 4 point 4.2 which regulates about Exclusion.

4. This insurance shall not cover any loss of, damage to and/or expense incurred in Motor Vehicle and/or legal liability against any third party when:

4.2. in the event of any loss or damage, Motor Vehicle is driven by a person who has no valid and proper Driving License (SIM) as regulated in prevailing laws and regulations concerning road traffic; This exlcusion does not apply in the case of loss for parked vehicle.

Therefore, please make sure that the Driving License you are having is in accordance with the type and use of the vehicle. When you experience an event that is considered as a risk in the Motor Vehicle Insurance Standard Policy (PSAKBI), we can proceed with your claim accordingly.

If you need further explanation or clarification regarding the policy’s terms and conditions, please contact us at 021 - 2523110 and it will be a pleasure to assist you.