Toyota Insurance

Product Description

Product Description – front page

Toyota Insurance is managed by MSIG, specially created for Toyota Cars by Toyota Astra Motor and provided by MSIG Indonesia. It covers motor vehicles against loss or damages with special features.

The 'Safe Driving Program' is a reward program given to Toyota T Intouch users with the aim of promoting 'Safe Driving Behavior' among Toyota car drivers.

**The Terms and Conditions are as Follows:

1. Applies for Toyota Insurance managed by MSIG policies from leasing and cash

2. Applies to policies with an inception date between November 21, 2023 and December 31, 2024 (one year).

3. Applies to comprehensive policies only with no claim history

4. Applies to Toyota Insurance policy user with driving score ≥95 (the score is the average score in a year)

5. The telematics device is always in active mode

6. Not applied for a prorate/full cancelled policy

7. Total maximum reward that can be enjoyed by Insured is IDR 2 Mio

8. The reward will be disbursed a maximum of 14 days after the expiration date.

How to Have a Good Driving Score?

Driving Score is obtained from the combined value of the data for acceleration (harsh acceleration), cornering (harsh cornering), and stopping (harsh braking). The less harsh acceleration, harsh cornering, and harsh braking, the better the driving score.

How to Join Safe Driving Reward Program?

Join our Safe Driving Program and win the prize by activating T Intouch.

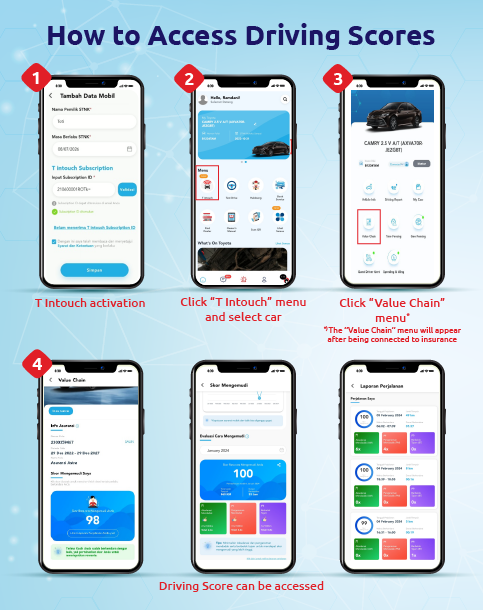

1. How to Access Driving Scores

2. Driving Score Display

Benefit of Toyota Insurance

• Repair at authorized workshop and guaranteed use of genuine Toyota parts

• One-Year repair result warranty (authorized workshop)

• Total Loss Only (TLO) in the event of a loss of 50% of the sum insured in the first year

• Inter-Island Risk

• 24/7 Call Center (021-2927-9656)

• Emergency Road Assistance (021-2927-9656)

Plan Highlights

- Toyota Insurance's special feature includes repair at any Toyota authorized workshop, with a guarantee of genuine parts repair result warranty of up to one year, and Emergency Road Assistance.

- Total Loss Only (TLO) in the event of a loss of 50% of the sum insured in the first year and can be extended with hurricane, storm, hail, flood, landslide, RSCC and earthquake coverage.

Benefits for Toyota MSIG Insurance Policyholders Who Activated for Telematic T Intouch

• Trip Report : driving score data (trip distance, route, duration, harsh braking, acceleration, cornering)

• Monthly Report : summary of monthly driving trip data

• Safety Map : time series of dangerous driving behavior

• Ranking : ranking among all user

• Reward : for users who can achieve monthly driving score target

-

Product enquiry

- Partner workshops

Plan details

Basic Coverage

Comprehensive

Comprehensive Policy covers the loss of or damage to the Motor Vehicle by:

Hull Damage

Comprehensive Policy covers total or partial loss of or damage to the motor vehicle due to the risks stated above.

Car with Sum Insured above IDR 200 million is required to have additional coverage.

Total Loss Only (TLO)

Only covers:

- Loss or damage, of which repair cost be equal or more than 75% of the actual value of the Motor Vehicle or

- Loss by theft and not found within 60 (sixty) days.

The TLO package is automatically bundled with coverage* of the following:

- Hurricane, Storm, Hail, Flood, Landslide.

- Riots, Civil Commotions, Strikes, Barriers to Work, Charges, Rebellion, Revolution.

- Earthquake, Tsunami or Volcanic Eruption.

*Coverage within Indonesia territory.

Special Features

- Repair at Authorised Workshop

- Guarantee using genuine Toyota parts

- Repair result warranty of up to one year.

- Interisland Risk

- Total Loss Only (TLO) for the first year is 50% of the Sum Insured

- Emergency Road Assistance (ERA) Service

- Towing Service:

- Emergency service: this additional service can be provided even if there is no loss to the Motor Vehicle

- Accident service: this additional service can be provided in the event of loss of and or damage to the Motor Vehicle

- Replacement of Tyre Leaking on the spot: the mechanic will replace the leaked tyre with the insured spare tyre.

- Repair of car battery on the spot: the mechanic will overcome the interference of the car battery.

- Emergency fuel assistance: the mechanic will provide a maximum of 5 (five) litres of fuel as an emergency measure to reach the nearest gas station.

Additional Coverage

- Hurricane, Storm, Hail, Flood, Landslide

- Riots, Civil Commotions, Strikes, Barriers to Work, Charges, Rebellion, Revolution

- Earthquake, tsunami or volcanic eruption

- Third Party Liability

Optional Coverage

- Terrorism and Sabotage

- Personal Accident for Driver

- Personal Accident for Passenger

- Loss or damage caused by embezzlement, fraud, hypnosis and such kind.

- Loss or damage due to malicious actions committed by:

- The Insured or his/her child or spouse

- Any Person acting on behalf of the Insured

- Any Person working for the Insured

- Any Person within the knowledge of the Insured

- Any Person living with the Insured

- Loss or damage as a consequence of:

- Towing or pushing another motor vehicle, racing purposes, tuition in driving, carnival or parade, or to commit a crime

- Overloading or driven by force

- Driving in a damages or technically unsafe condition

- Being driven by a person not holding a valid driving license (S.I.M) or under the influence of alcohol or any other drugs

- A nuclear reaction or radiation

- Loss or damage directly or indirectly caused by natural disaster or war

- Loss or Damage to any part or material of motor vehicle due to wear and tear, inherent vice of that part

- Other exclusions as defined in the insurance policy

SAFE DRIVING PROGRAM

| No. | Questions & Answers |

|---|---|

| 1 | What is a 'Safe Driving Program'? The 'Safe Driving Program' is a reward program given to Toyota T-Intouch users with the aim of promoting 'Safe Driving Behavior' to Toyota car drivers. The terms and conditions are as follows:

|

| 2 | What is the ‘Driving Score’? Driving Score is the value of driving a car per trip made by car users, which is obtained from T Intouch data that has been activated. This value is a combined assessment of the data for acceleration (harsh acceleration), cornering (harsh cornering), and stopping (harsh braking). This Driving Score data is provided and can be viewed by accessing and registering in the WebUI (website user interface). |

| 3 | Who can get the Driving Score data? This Driving Score data is given to car users who activate T Intouch and have a Toyota Insurance policy and register themselves on the WebUI (user interface website). In addition to displaying Driving Score data, WebUI also provides driving data such as a summary of the monthly Driving Score, Safety Map, and User Rating compared to all T Intouch users. |

| 4 | How to register on WebUI? The WebUI link can be found on MToyota by accessing the T Intouch menu, clicking Value Chain, then clicking the Driving Score button. Or you can visit the page: https://id.ldcm-scoring-system.driving-report-aisia.com/. |

| 5 | What are the advantages of registering on WebUI? Users can find out how they are driving through data and Driving Score displayed on WebUI. Can find out the shortcomings of how to drive a car and can further improve the Driving Score from the displayed data. |

| 6 | How to have a good Driving Score? Driving Score is obtained from the combined value of the data acceleration (harsh acceleration), cornering (harsh cornering), and stop (harsh braking). The less harsh acceleration, harsh cornering, and harsh braking, the better the Driving Score. |

| 7 | When and how is the reward received by the User? Toyota Insurance party will contact Users who meet the terms and conditions of the Safe Driving Program no later than seven working days after the annual Average Driving Score data is available. After the User confirms the details required by Toyota Insurance, the reward will be received by the User no later than seven working days. |